Framework to Track Humanoid Robot Progress, Is the Demise of Consulting Overstated and China’s Hijacking of America’s Climate Fears

Notes from My Weekly Feed # 10

This is my 10th post in 10 weeks and looks like I may be finally building some discipline and cadance (famous last words maybe?). Writing consistently has definitely been a great hobby so far - it forces me to understand, articulate and refine my own views on things I am interested in. I really hope that some of this has been helpful and/or insightful for you as well so far.

If you are here for the first time - would love for you to subscribe to this newsletter and provide any feedback / comments. With that said, lets get into why both you and I are here!

The MIND Framework: A Mental Map to Track Humanoid Robot Progress

A few weeks ago, I wrote about why humanoid robots are suddenly everywhere (in the news) and why most aren’t as capable as the hype suggests. My two main takeaways from prior post: (1) they’re advancing quickly enough to play a role in re-shoring high-tech manufacturing, and (2) not quite as fast as Tesla would like you to believe, a narrative that helps justify its lofty valuations.

Since then, I’ve gone deeper down the rabbit hole in the hopes of doing a deep dive essay in the near future. Deep enough that I needed a mental model to make sense of what’s actually working, what’s not and how to track progress in this field. That’s how the MIND framework came about: MIND starts for the 4 key axis of development in Humanoid Robots - Motion, Intelligence, Navigation, Dexterity.

M – Motion

Large-scale movements like walking, turning, or balancing. Most major players—Tesla, Figure, Agility, Apptronik—have cracked this. Advances in actuators, materials, and control systems mean this isn’t the bottleneck anymore.

I – Intelligence

The explosion in AI capabilities, especially LLMs, has dramatically improved how humanoid robots can process commands, make decisions, and adapt in real time. While not solved, this bucket is advancing rapidly and isn’t the limiting factor in deployment right now.

N – Navigation

Robots today can navigate fairly well through structured indoor environments using a mix of sensors (LIDAR, cameras etc.) and algorithms. Most robots can localize themselves, build maps, and avoid obstacles with decent reliability.

D – Dexterity

This is where things are still nascent and a lot of progress is still needed. Robots can walk, talk, and even do backflips but most still struggle with basic tasks like folding laundry or picking up a glass of water. Real-world manipulation requires fine motor skills, tactile sensing, and adaptive control. We’re not really close on this one.

(P.S. If you missed my post on the tactile sensor challenge, it’s here)

Jim Fan, Director of AI at Nvidia, calls this the “mini Moravec’s paradox” (see tweet below) which helps explain why robots can do backflips, but can’t fold a towel.

Flashy tasks like parkour and flips are easy to model in simulation. The physics are predictable, the environment controlled, the goals clear. Run enough simulations, and you can brute-force your way to something that looks impressive in recorded videos.

But real-world manipulation is messy. Folding a towel or twisting a bottle cap means uncertain surfaces, shifting weights, and noisy feedback loops. Contact physics are hard to simulate. Tactile sensors that help navigate contact physics are hard to build and even harder to interpret in real time.

My key takeaway from this tweet is that humanoid robots built for factory settings, performing defined and repetitive tasks, are likely much closer to reality than general-purpose home robots folding laundry or pouring a glass of water.

So, I would be careful investing in companies promising a near-future such as that shown in the video below.

You can already pre-order this laundry folding lamp here www.hello-lume.com. Maybe we should start a Polymarket bet on how soon will they actually deliver?

The Demise of Consulting is Overstated

There’s been a growing chorus lately predicting the demise of consulting (Wall Street Journal, The Economist, The Free Press).

A recent WSJ piece suggests that generative AI is undermining the core value proposition of firms like McKinsey and BCG. A Free Press post goes further, calling the current consulting downturn a harbinger of a more existential collapse. And of course, the famous Peter Thiel quote. I would not be surprised if it was this Peter Thiel quote that led to all this media attention on Consultings vulnerability to AI.

“Timing the market is not my thing, But if the consulting business was a stock, I’d be shorting it right now”

These takes are spicy. But they also feel wildly overstated.

Consulting isn’t some fragile, tech-oblivious business that stumbled into 2025 unprepared. This is a profession that’s thrived through wave after wave of disruption - personal computing, the internet, cloud, mobile, SaaS etc..

And every time, the same thing happened: more change = more demand for interpreters of change.

And more importantly, I don’t think that consultants are just glorified slide-makers. They’re more often than not, a shield that management teams like to have when navigating tough / important decisions.

Let’s say a CEO needs to cut costs. The management team knows what needs to be done but still they bring in McKinsey. A few weeks later, they announce a 25% headcount reduction. The story practically writes itself: “We evaluated every option. Even McKinsey agrees—this was the least bad path.”

It’s about external validation and political air cover. That part of the business isn’t going away.

Now enter AI. Will it replace some of the traditional grunt work at the consulting shops? Of course. But that just means these firms can do more with fewer people.

Meanwhile, as more companies get whiplashed by AI, boards and exec teams will want help making tough decisions. They would want their shields.

So here’s my humble take: I think AI will have two effects on consulting shops:

(1) these consulting companies can do more with less and

(2) as enough companies get disrupted by AI, they will seek external validation for tough decisions that will increase the demand for these consultants

As a combination of (1) and (2) I foresee that in the medium term:

(a) top line will increase net-net (downward pressure on revenue per engagement will be offset by greater number of engagements as the same companies navigate AI) and

(b) margins will increase as these consulting shops do more with less human capital than what they needed previously

So in summary, I think people who predict the demise of consulting deeply under-estimate the reason why companies need strategy consultants. It’s not for their pretty slides - at least not always. It’s for the fact that the consultants serve as a high quality shield for management teams.

And as long as the management teams themselves are human (who knows for how long), consulting will not only survive but evolve and thrive, like it always has.

Chart of the Week and How China Hijacked America’s Climate Fears (The Free Press)

Now, this may still be in the conspiratorial corner, but when Doomberg speaks, I listen. As a group, the Doomberg group is one of the most respected energy analysts on Substack and recently, they published a peice on The Free Press, which at the very least is worth considering despite one’s politics.

Here is a brief summary.

“On June 25, U.S. senator Ted Cruz chaired a remarkable Senate subcommittee hearing. The focus was on allegations that the Chinese Communist Party (CCP) financially supports climate activists to hinder American energy development. Cruz did not mince words as he outlined what he and fellow Republicans view as the CCP’s three-part strategy to weaken its primary geopolitical rival

“First, foreign money from entities tied to the Chinese Communist Party flows into the United States to bankroll climate advocacy groups who litigate against American energy.

Second, activist lawyers flood our courts with lawsuits designed not to win policy debates but to bankrupt energy producers and to dismantle energy infrastructure through sheer attrition.

Third, the judiciary itself is being quietly captured and brainwashed as left-wing nonprofits host closed-door trainings that indoctrinate judges to adopt the ideological goals of the climate lawfare machine.

For evidence, Cruz pointed to cash outlays at a nonprofit called Energy Foundation China (EFC), based in San Francisco. According to its website, EFC has disbursed over $500 million to more than 4,000 climate-related projects. Its CEO and president, Ji Zou, is based in Beijing and has a background consistent with strong CCP affiliation. For example, he was a “key member of the Chinese climate negotiation team leading up to the Paris Agreement,” according to his online bio.

Democrats, for their part, accused Cruz of promoting conspiracy theories, dismissing established science, and turning a blind eye to the influence of hydrocarbon industry money in Washington. Rather than address or deny concerns about Chinese influence, they directed their remarks and structured their witness testimony around the financial risks posed by climate change.”

Now whether one chooses to believe this or not till concrete evidence is presented is another matter. But in light of what was alleged, one needs to think how China benefits from this, assuming the allegations are true.

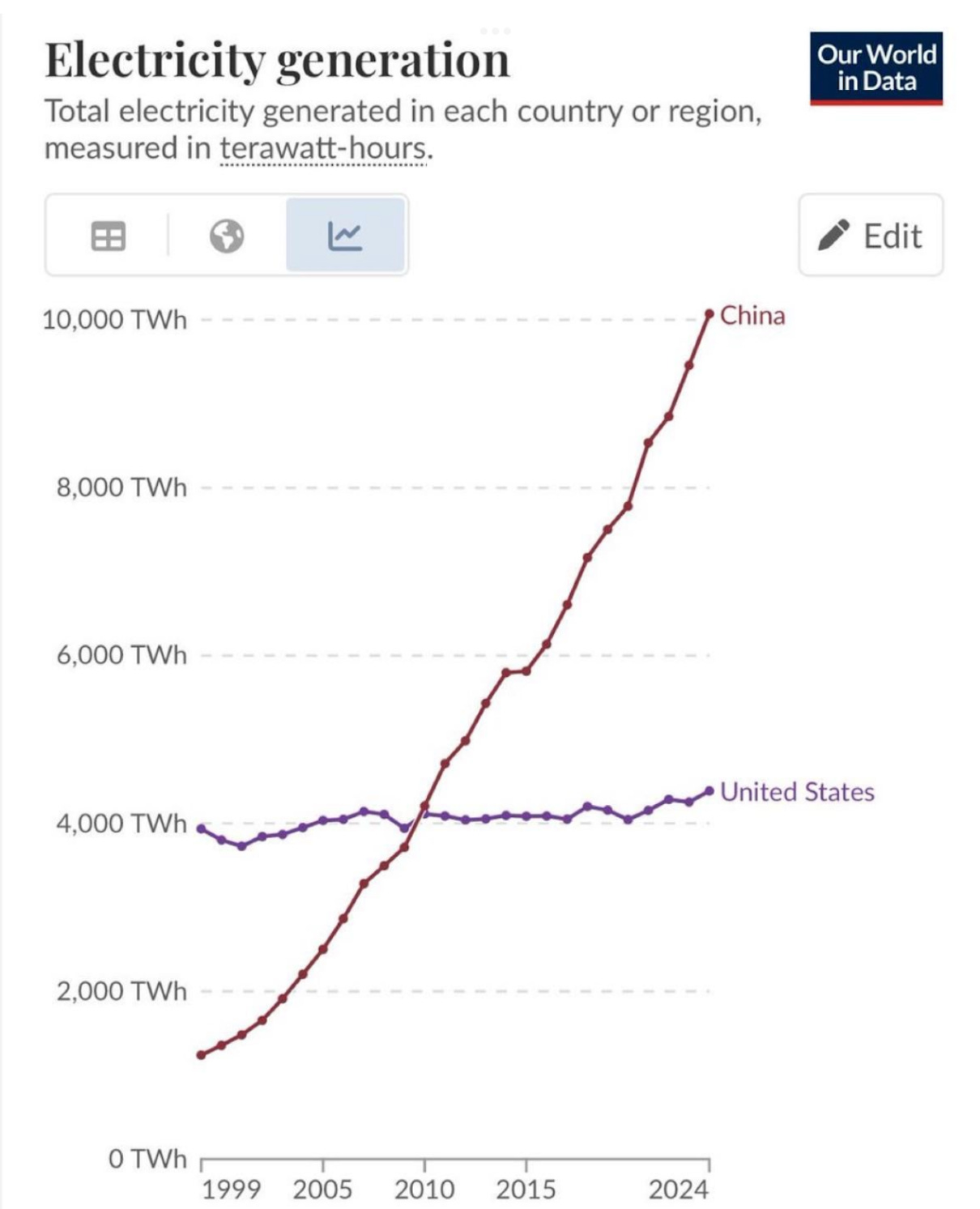

While many Western countries have slowed or halted the development of major energy infrastructure paralyzed by permitting delays, political gridlock, or overly narrow bets on specific technologies—China has doubled down on an “all of the above” strategy. It is simultaneously building out coal, nuclear, hydro, solar, wind, and battery storage at breakneck speed. This relentless buildout has already allowed China to leapfrog the U.S. in total power generation capacity (chart below). More importantly, this capacity is not just a statistic - it’s the foundation upon which heavy industry, advanced manufacturing, and, increasingly, AI-driven digital infrastructure is built. As the world enters the age of energy-hungry datacenters, China’s surplus of cheap, abundant electricity puts it in a uniquely advantageous position to scale up faster, cheaper, and more decisively than its peers.

That’s all for this week folks. See y’all next week.