Notes From My Weekly Feed # 4

When Dubai Almost Became a Part of India, Zohran MEMEdani, The Irish Tax Magic, The “Real” Breakeven Cost of Saudi Oil and The Straits of Hormuz

TIL: When Dubai Almost Became a Part of India (BBC)

This was honestly news to me - and a fascinating one at that.

Dubai and much of the Persian Gulf were officially considered part of British India under the Interpretation Act of 1889, which was passed by the UK Parliament. This act legally deemed Muscat, Doha, Dubai, and other regions of the Persian Gulf as integral parts of India. Yemen was the first to be partitioned from India on April 1, 1937, and a decade later, on April 1, 1947, most of the Persian Gulf followed. Technically, these Middle Eastern states are the only remaining princely states from the old British Raj that still function like princely states - while those within the Indian subcontinent were all eventually integrated into modern-day India.

There is, theoretically, a parallel world where much of the Middle East—from the UAE to Yemen—could have become part of India, if not for the complete lack of interest among Indian independence leaders in shaping modern India around the cultural heritage of the broader subcontinent.

British officials briefly discussed whether India or Pakistan would "be allowed to run the Persian Gulf" after independence, yet a member of the British legation in Tehran even wrote of his surprise at the "apparent unanimity" of "officials in Delhi… that the Persian Gulf was of little interest to the Government of India… The Gulf states, from Dubai to Kuwait, were thus finally separated from India on 1 April 1947, months before the Raj was itself divided into India and Pakistan and granted independence… Without this minor administrative transfer, it is likely that the states of the Persian Gulf Residency would have become part of either India or Pakistan after independence, as happened to every other princely state in the subcontinent.

Prior to the partition, Indian Passports were issued as far west as Modern Day Yemen that was considered part of India’s Bombay Province and was technically India’s westernmost point. And even after the partition, India’s influence on the Persian Gulf persisted till 1971, when the British finally pulled out of the entire region.

When Mahatma Gandhi visited the city in 1931, he found many young Arabs identifying as Indian nationalists… (Post-partition in 1947 till 1971)… The official currency was still the Indian rupee; the easiest mode of transport was still the 'British India Line' (shipping company) and the 30 Arabian princely states were still governed by 'British residents' who had made their careers in the Indian Political Service.

What was also interesting is how those from the region who remember the time under the British Raj resent the general attitude of the “Babus” for Indian Political Services who administered the region.

In 2009, Gulf scholar Paul Rich recorded an elderly Qatari gentleman who "still got angry when he related to me the beating he received when as a young boy of seven or eight he stole an orange, a fruit which he had never seen before, from an Indian employee of the British agent… The Indians, he said, were a privileged caste during his youth, and it gave him immense pleasure that the tables had turned and they now came to the Gulf as servants."

That last line is interesting! I thought there was a sharp undertone of gratification here - a sort of schadenfreude wrapped in a karmic role reversal in the region

Zohran MEMEdani

I suppose no post this week would be complete without at least a passing homage to the latest online obsession: Zohran Mamdani becoming the Democratic nominee for NYC Mayor.

To be honest, I’ve only spent maybe 20–30 minutes on it—mostly watching an Indian YouTube channel break it down - so I’ll hold off on forming any strong opinions until I’ve actually done my homework.

In the meantime, this meme felt like a pretty accurate summary of the discourse so far.

The EU’s Secret Weapon: Irish Tax Magic

The EU recently revised up its quarterly GDP growth - a rare pleasant surprise for a region short on good economic news. But dig a little deeper, and something weird pops up: roughly half of that growth came from Ireland, a country with just 1% of the EU’s population. A country of 5 million quietly steering the GDP of an entire continent.

So how do 1% of people deliver 50% of that continent’s growth? Through, one of the most effective corporate tax arbitrage models in economic history.

Ireland’s corporate tax rate is a rock-bottom 12.5%, compared to 21% in the U.S. (which used to be ~35% before the 2017 tax cuts). American tech giants legally leverage this delta to move profits out of the U.S. and into Ireland - lowering tax bills and juicing margins, all within the rules.

Let’s walk through a (simplified but directionally accurate) example:

Imagine Google engineers in California develop an improved YouTube algorithm that boosts monetization

Google then sells this intellectual property (IP) to Google Ireland — a separate legal entity, for tax purposes

The IP, at this point, is valued based on projected future cash flows — which are, conveniently, just assumptions. So Google can “sell” this IP to its Irish arm for what amounts to peanuts

When the algorithm is deployed and YouTube profits soar globally, including in the U.S., those U.S. profits are suddenly burdened by… a new expense: a licensing fee paid to Google Ireland for using the very IP that was developed in California

Now instead of paying U.S. taxes on $100 billion in profits, Google U.S. shows only $50 billion in profit - because it “paid” $50 billion in licensing to Ireland (I am assuming notional licensing fee number here to illustrate the idea). That $50 billion is now taxed in Ireland, at 12.5%.

This arbitrage - multiplied across dozens of companies - has turned Ireland into the oil state of the digital economy. Except it’s not sitting on natural resources. It’s sitting on legal code.

Corporate tax law is Ireland’s equivalent of an oil field. And it’s pumping out GDP growth, trade surplus figures, and tax revenues at a level totally uncorrelated to its actual industrial base.And unlike Norway, which took its oil bonanza and built one of the world’s largest sovereign wealth funds, Ireland has spent most of the windfall.

The Irish Fiscal Advisory Council has warned of “Dutch disease” - the economic imbalance that hit the Netherlands in the 1970s when gas revenues distorted everything else. Ireland’s version is subtler but more fragile. In 2023, just three companies accounted for 38% of all corporate tax receipts. That’s not diversification - that’s dependence.

And the risk isn’t hypothetical. Trump-era tax reforms already tried to close this loophole once. A second Trump term or global minimum tax enforcement could rip the foundation right out from under Ireland’s model. Worse, only around €16 billion of the €160 billion in corporate tax earned over the past decade has been saved. The rest? Spent.

For now, the trick still works. Ireland keeps delivering outsize GDP numbers. U.S. companies keep shifting profits. EU headlines keep looking rosier than the reality.

But even magic runs on a clock. And Ireland is living off an economic illusion that depends entirely on companies it doesn’t control, markets it doesn’t own, and rules it didn’t write.If oil-rich countries feared running out of fossil fuels, Ireland should fear running out of favorable tax code.

Final closing thoughts from the Economist article that inspired this post:

The Irish Fiscal Advisory Council has warned of Ireland falling prey to “Dutch disease”, the imbalance that struck the Netherlands in the 1970s as natural-gas money sent the rest of its economy off-kilter. Unlike oil, nobody knows when the fiscal bonanza will run out. Just three companies accounted for 38% of all corporate-tax receipts in 2023, leaving Ireland exposed to the success of foreign firms over which it has no sway….Nobody knows either how Mr Trump might change tax rules or impose tariffs to Ireland’s detriment. Ideally the authorities there should have squirrelled away their tax windfall in a long-term fund, as Norway did with its oil revenues, better to manage if the windfall ends. In practice, says Dan O’Brien of the Institute of International and European Affairs in Dublin, only about a tenth of the €160bn earned in the past decade from corporation tax has been saved. A mix of pluck and luck has been good to the Irish. They will have to hope their good fortune can endure.

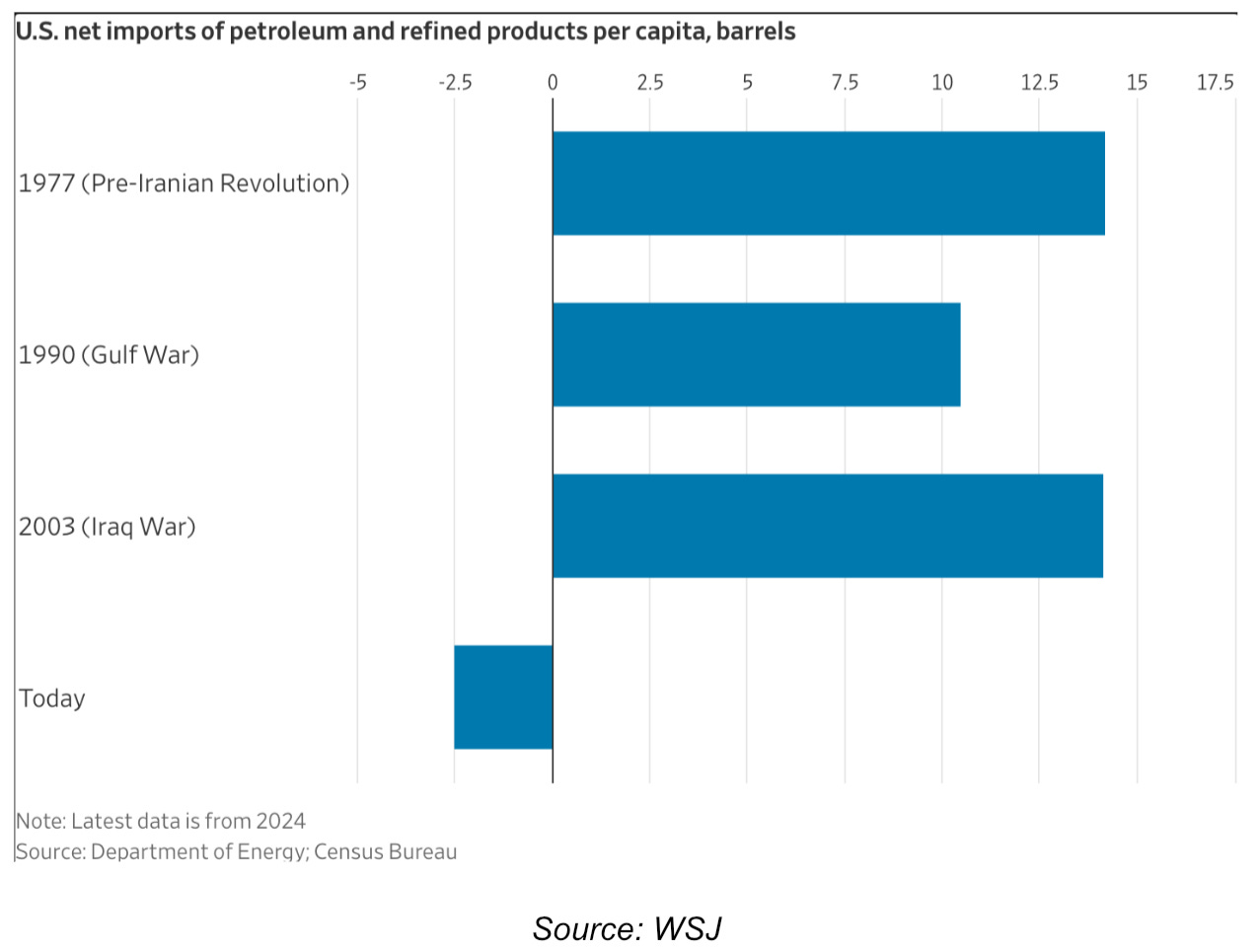

Will Iran Go Scorched Earth on Strait of Hormuz and Score a “Pyrrhic victory” (WSJ)

Oil markets have seen plenty of chaos, but few pressure points are as critical - or as fragile - as the Strait of Hormuz. This narrow stretch of water moves about 20% of the world’s oil and has been back in the headlines as tensions between Iran and Israel rose.

The idea of Iran going scorched earth and shutting down the strait gets thrown around every time things heat up in the region. But most observers tend to dismiss it as bluff: Iran depends on Hormuz too. Around 90% of its own oil exports pass through it, and the U.S., unlike during the 1973 embargo, is now largely energy independent thanks to the shale boom.

What’s different this time is China. While the U.S. can ride out disruptions, China is deeply exposed. Over half of China’s oil and more than three-quarters of its LNG flow through the Strait of Hormuz. China doesn’t have domestic substitutes like U.S. shale or Canadian pipelines to fall back on. And a huge portion of its crude imports come from countries in the Gulf - especially Iran. So if Iran actually followed through on the threat and tried to choke off the strait, it wouldn’t just hurt the West - it would directly undercut Beijing’s energy security and economic stability. That’s a tough move to square when China is one of the few global powers still willing to do business with Tehran.

Iran, in effect, is boxed in. The Strait of Hormuz is its biggest geopolitical lever, but pulling it too hard risks unraveling its most important relationship. Shutting down the strait would tank oil revenues, invite a U.S. naval response, and inflict collateral damage on China, just as Beijing is trying to stabilize its economy and expand its influence across the region. That’s why the threat always simmers but never boils over. Iran needs the strait open almost as much as everyone else does - and maybe more, now that China sits on the other end of the route.

A move like this would be a classic Pyrrhic victory - to borrow the term the WSJ used recently - a show of strength that causes more damage to itself than to its adversaries. The concept of a “Pyrrhic victory” comes from King Pyrrhus of Epirus, who led a costly campaign against Rome in the 3rd century BC. Though he won battles, his army suffered irreparable losses. After one such win, Pyrrhus reportedly said, “If we are victorious in one more battle with the Romans, we shall be utterly ruined”. That may well be the fate awaiting Iran if it pulls the trigger on Hormuz. It might rattle the markets. It might even look like strength. But it would be a win that unravels Iran’s alliances, empties its coffers, and deepens its isolation. That’s not a strategy - that’s a “Pyrrhic victory”.

Breakeven Cost of Saudi Oil

When we usually talk about breakeven oil prices, we think in terms of production costs. But for Saudi Arabia, oil isn’t just a commodity - it’s the backbone of fiscal policy. So there’s another way to look at breakeven: the fiscal breakeven price—the oil price needed to balance the national budget.

According to Bloomberg, that number now sits at $96/bbl, and $113/bbl if you include spending by the Public Investment Fund (PIF), the kingdom’s sovereign wealth fund.

Then again… this only matters if you actually care about balancing your budget. And let’s be honest - do we, really (jk)?

That’s all for this week. See y’all next week.