Why Has the U.S. Economy Not Tanked Despite Tariffs, PELOSI to Ban $NANCY, Shifting European Priorities, U.S. Government now Accepts Venmo, and On Reading Charts

Notes from My Weekly Feed # 9

Excerpt of the Week - PELOSI Aims to Abolish $NACY”

A few weeks back I wrote about the two ETFs, $NANCY and $KRUZ that allow rest of us to invest similar to how some politicians do. Here is a fun little update on the same topic from the Free Press.

“Nancy Pelosi endorsed a congressional stock trading ban, dubbed The Honest Act. Then introduced by Republican senator Josh Hawley, the bill was originally named Preventing Elected Leaders from Owning Securities and Investments, or PELOSI. Hawley changed the name to win Democratic support, which he now has, earning the ire of President Trump. See, the Pelosis were legendary stock pickers, some of the best (imagine that!), and people have made tools like Nancy Pelosi Stock Tracker to help retail investors get in the game. We can never guess how she always knew which company was to be investigated, which one censored, and which would get the government contract. But she was always ahead of the curve. Nance can smell blood in the water.

Pelosi, who I genuinely think is fabulous, said this: “If legislation is advanced to help restore trust in government and ensure that those in power are held to the highest ethical standards, then I am proud to support it—no matter what they decide to name it.” Chic as hell. A human string of pearls atop a perfectly tailored, $10,000 jacket.”

Everyone Told Us The American Economy is Going to Sink - Why Has it Not “Yet”?

On the heels of the Liberation Day tariffs announced back in April, a broad swath of the economic commentariat didn’t just predict a downturn, they declared it inevitable. I remember a popular Youtube commentator emphatically stating: “Now everyone will finally understand how economics works.” Honestly? I loved that. Because I, too, wanted to understand how the economy works, and we were about to live through a real-life macroeconomic experiment.

Candidly, I was convinced. This was it. The moment the economy keels over. And it still might. But as of now - late July - it hasn’t. In fact, it’s doing the opposite of tanking. The S&P is up ~8% year-to-date. The GDP data released this past Wednesday showed the U.S. economy grew by ~3% Y-o-Y. A recent Wall Street Journal report added some other data points that suggest things are not as bad as they were expected to be.

”Economists surveyed by the Journal this month estimate the economy grew by about 2% in the second quarter, accelerating out of the first three months of the year. They think the odds of a recession in the next year are just 1 in 3. Core inflation remains below 3%, down from 3.5% at the end of last year. Equity markets are reaching new highs as investors have recovered from their panic attack of April.”

So naturally there is a lot of interesting discussion around why has the economy fared way better than expected so far. And here’s a roundup of the most interesting takes I have come so far. Credit where due, these reasons are a mash of what I found most interesting from those offered by the economist Noah Smith, The Atlantic’s Derek Thompson (co-author of The Abundance), and Jason Furman (Harvard Economist and former Obama economic advisor) all offered some of the more compelling rationale.

First, the boring answer but possibly the most legit explanation: we’re just early.

Some of the tariffs announced back in March were delayed, revised, or scrapped altogether. Given the uncertainty, the full impact hasn’t made its way to consumers yet - many importers are still waiting to see where things land before passing costs through.

On top of that, importers front-loaded shipments ahead of the tariffs, so much of what we’re buying today was grandfathered in tariff-free. The theory goes: once that inventory cycles out and the tariff-laden goods hit shelves, we’ll start to see higher prices and softer demand, which will ripple through the economy, hit corporate earnings, and - eventually, finally - get the market’s attention.

Second, maybe the “massive hit” was just… not that massive.

In the podcast with Derek Thompson, Furman said that the Economists estimated the impact of tariffs at around $200–300 billion. A big number, sure, but also just ~1% of the U.S. GDP. The thesis goes that the American economy is just too massive and resilient that it is able to survive a bad policy better than most think. So when economists screamed “huge recession,” they mean it in the way policy people do: like someone yelling “fire” and calling 911 because the microwave made a weird noise. Not wrong - just operating on the kind of urgency that comes from too much time around a thinktank’s whiteboard and not enough time spent in real-world industries.

Third, it turns out tariffs aren’t paid like a tax at checkout counters in stores.

We assumed consumers would bear the full brunt of tarriffs. The daily show hosts, every expert on TV and on YouTube and so on would keep saying “You know who pays the Tariffs? It’s the U.S. Consumers dummy!” and everyone nodded and agreed (so did I).

But real-world supply chains are messier - and a lot more strategic.

Let’s walk through a basic example using TVs, a mostly undifferentiated product.

A U.S. electronics retailer imports TVs assembled in China. Those Chinese factories are usually assembling components sourced from a dozen other suppliers - screens, casings, circuit boards - all often made nearby. These factories run on razor-thin margins and need to keep their production lines humming to stay afloat. If tariffs drive up prices and U.S. consumers stop buying TVs, demand dries up, and those factory floors go quiet - that’s a problem for the Chinese business too!

So what happens? Everyone across the value chain starts making compromises to protect their share of the pie.

Chinese factories might lower the price they charge U.S. importers just to keep orders flowing. That means the tariff is applied to a lower base cost to begin with. U.S. importers, facing competition from rival brands, might then choose to absorb part of the tariff themselves rather than raise prices and lose sales. Retailers, too, might trim margins a bit to avoid sticker shock on the shelf.

All of this softens the blow for the consumer. The tariff cost gets diluted across the chain - it’s a classic game theory squeeze, played out in container ships and warehouse aisles.

Now, this dynamic works best with undifferentiated products - things where customers don’t really care whether they’re buying a Vizio or a TCL as long as the screen is big and the price is low. For more specialized or premium goods, producers might feel more confident passing the entire cost along. But in commodity categories, that’s rarely how it plays out.

So no, the full weight of tariffs didn’t slam directly into the consumer’s wallet. It got scattered across the value chain, cushioned by competitive pressure, thinning margins, and a global game of “please don’t cancel the order.”

Fourth, the Fed’s been holding down the inflation fort.

Rates remain high - especially relative to other OECD nations - which has helped cool inflationary pressure even as tariffs loom in the background. A hawkish Fed might not be great for homebuyers, but it has bought the macroeconomy some breathing room. Essentially, higher interest rates are counterbalancing any inflationary impact that the Tariff may have had on its own.

Fifth, oil prices have stayed unusually low—and that’s helped.

Energy prices play an outsized role in shaping the broader economy. When oil is expensive, it doesn’t just hurt drivers - it raises the cost of everything from shipping to plastics to airfares. When it’s cheap, it helps offset inflationary pressures elsewhere. Since Trump took office, oil prices have remained relatively low. Part of that has to do with OPEC+ lifting its production cap, which brought more barrels into the market and kept supply flush. While the producers have remained cautious about calls to “Drill baby Drill”, general ease of doing business and bringing in new production has helped keep oil prices low that has kept inflation and as such the broader economy in check!

So Why Hasn’t The Economy Tanked?

So maybe the real takeaway here isn’t that the doomsayers were wrong, or that the economy is invincible.

It’s that systems this large and this complex don’t always bend to clean narratives or immediate consequences.

Policies take time to bite. Markets overreact, then forget. And sometimes, a bunch of imperfect decisions still add up to a surprisingly stable outcome.

I’m not saying we’re out of the woods - but if this was supposed to be the great unraveling, it’s been oddly well-behaved so far.

And yes, it's been fun to learn how the economy really works and realize that well, I have no clue how it really does!

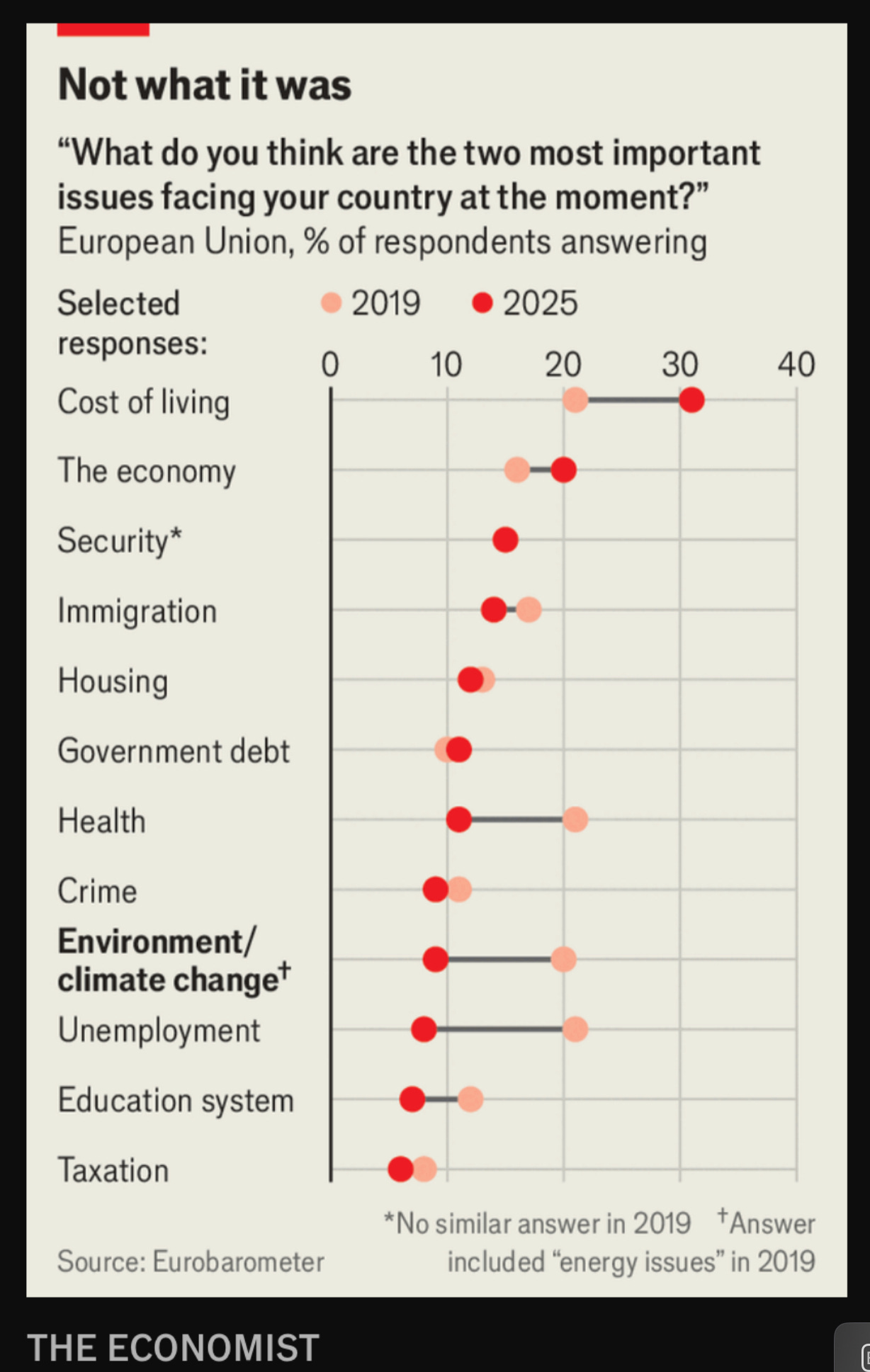

Chart of the The Week # 1- How European Priorities have Shifted Since 2019

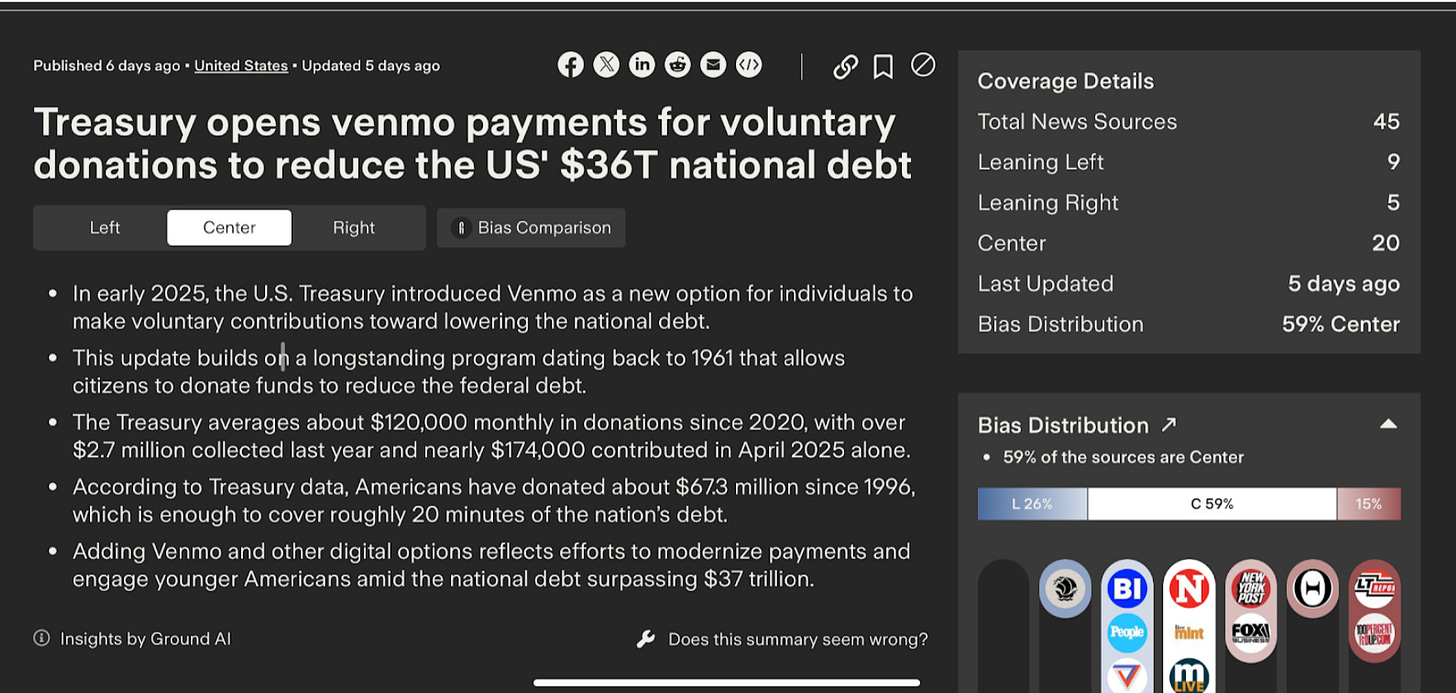

You Can Now Venmo the U.S. Government to Help it Pay Down It’s Debt

A few weeks back, I wrote about why gold prices are ripping and why some folks are parking their hopes, and money, in bitcoin. At the core of it all: growing concern around the U.S. fiscal deficit.

If you too have been losing sleep over our $37 trillion tab, the U.S. government has finally given you a chance to do something about it. You can now Venmo them.

This is apparently part of a longstanding program (since 1961) that lets Americans make voluntary donations toward reducing the national debt. The Treasury has now modernized the experience for the mobile-first generation. Tap, pay, patriotism.

The numbers, as you’d expect, are… humbling. About $2.7 million was collected last year. That’s roughly the interest on the national debt for about 40 seconds. But, April 2025 alone saw $174,000 in contributions - which means someone out there looked at their tax return and thought, You know what, not quite done yet.

According to Ground News (clip below), this story has managed to unite left, right, and center media - which might be the most surprising part of all. So if you were wondering what could bridge the political divide in 2025, apparently it’s a shared fascination with Venmo-ing the government.

Chart of the The Week # 2 - Notice Anything Off Here?

Whoever is responsible for the Democrat party’s official twitter account unfortunately missed a few too many classes on how to interpret charts.

That’s all this week y’all. See you next week.